TODAY'S STUDENTS,

TOMORROW'S SKILLED WORKERS

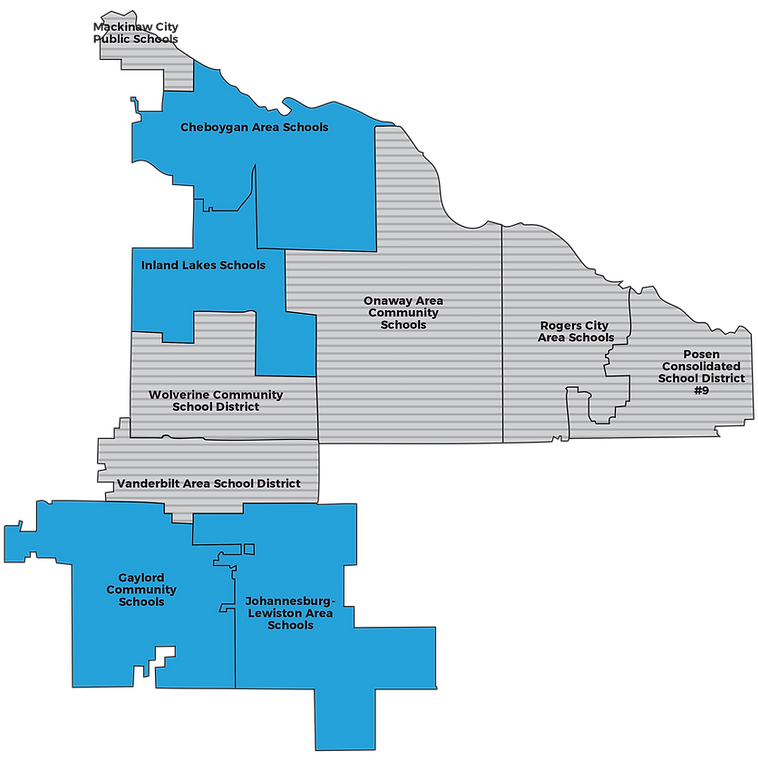

On Tuesday, November 4, 2025, residents of the Cheboygan-Otsego-Presque Isle Educational Service District (COPESD) will vote on a career and technical education (CTE) millage.

If approved, all of the revenue generated by this levy for the next six years would support the expansion and enhancement of vocational education programs in schools throughout the region.

Under this proposal, industry partners would advise COPESD and local school districts on CTE curriculum and program development to align student learning with the current and emerging needs of our regional workforce.

COPESD also has a group of business, agency and school partners focused on eliminating barriers across our region to help foster more of these opportunities to connect the students with skills and careers within our communities.

By taking a collaborative and regional approach, we can offer a greater variety of LOCAL vocational programs than any single school district could provide alone.

LEARN MORE!

Click the video to learn more about the CTE millage on the November 4 ballot for school districts throughout the Cheboygan-Otsego-Presque Isle Educational Service District. The video is also available here: https://vimeo.com/1117841852?fl=ip&fe=ec

EXPANDING CTE ACCESS

COPESD is currently one of 15 education service districts throughout Michigan without a CTE millage. Programs providing students with technical and vocational education are available today at only four of the 10 school districts within the Cheboygan-Otsego-Presque Isle Educational Service District.

If voters approve the CTE millage on the November ballot, all of the funds generated by the new levy would support existing programs and be used to create new programs in areas currently without these services.

94% of CTE millage funds would flow to LOCAL school districts and program partners

THE PLAN

The CTE millage is designed to encourage the operation of area vocational programs. The program proposal would do the following based on a collaborative approach:

Each school district throughout the region will manage and/or expand the current number of vocational programs. Funds from the CTE millage would flow directly to school districts to operate these programs.

By taking a collaborative and regional approach, this will result in a greater variety of CTE and vocational programs than any single school district could provide alone, expanding opportunities for students while providing much greater stability for the programs themselves.

Strong partnerships established between schools and local businesses, innovative vocational education programs, and a commitment to student achievement would help build a more skilled workforce that would benefit our students, our community, and businesses in our region.

WHAT DOES THIS MODEL LOOK LIKE ELSEWHERE?

Currently, six of the 10 school districts within the COPESD do not have CTE and vocational programs.

Comparatively, neighboring Charlevoix-Emmet Intermediate School District has programs in place at all 11 of its school districts using CTE millage funds.

Charlevoix-Emmet ISD uses a consortium model that is similar to what is being considered by voters on November 4, 2025.

Here is an interactive map showing what programs are available across Charlevoix-Emmet ISD.

With CTE millage funds, vocational programs would be offered at LOCAL school districts in partnership with businesses and industries in EACH community

TAX IMPACT

If decided by voters, the measure on the November ballot would increase the mill rate by $1.00 per $1,000 of taxable value for a period of six years (through 2031). For every $100,000 in taxable home value, the cost is $100 annually, or $8.33 per month.

This mill rate increase would affect property owners in school districts across the Cheboygan-Otsego-Presque Isle Educational Service District.

DID YOU KNOW?

COPESD's cumulative property levy rate is the fourth-lowest among Michigan’s 56 education service districts.

FREQUENTLY ASKED QUESTIONS

.png)

.png)

.png)

.png)

.png)